Renters Insurance Buy Cheyenne | Explained in Detail

Are you planning on buying renters insurance in Cheyenne but don't know where to start? Look no further! In this article, we'll explain everything from the basics to the benefits of having renters insurance in Cheyenne.

Have you ever thought about what would happen if there was a flood in your apartment and you lost all your belongings? How would you replace everything? That's where renters insurance comes in handy. Renters insurance provides you with protection against various damages and losses, which can give you peace of mind knowing that you and your belongings are safe.

"I never thought I needed renters insurance until my apartment flooded. My policy saved me from a lot of financial stress and I'm grateful I had it." - John, Twitter

Overall, having renters insurance is a wise investment to protect yourself and your belongings.

The Benefits of Renters Insurance in Cheyenne

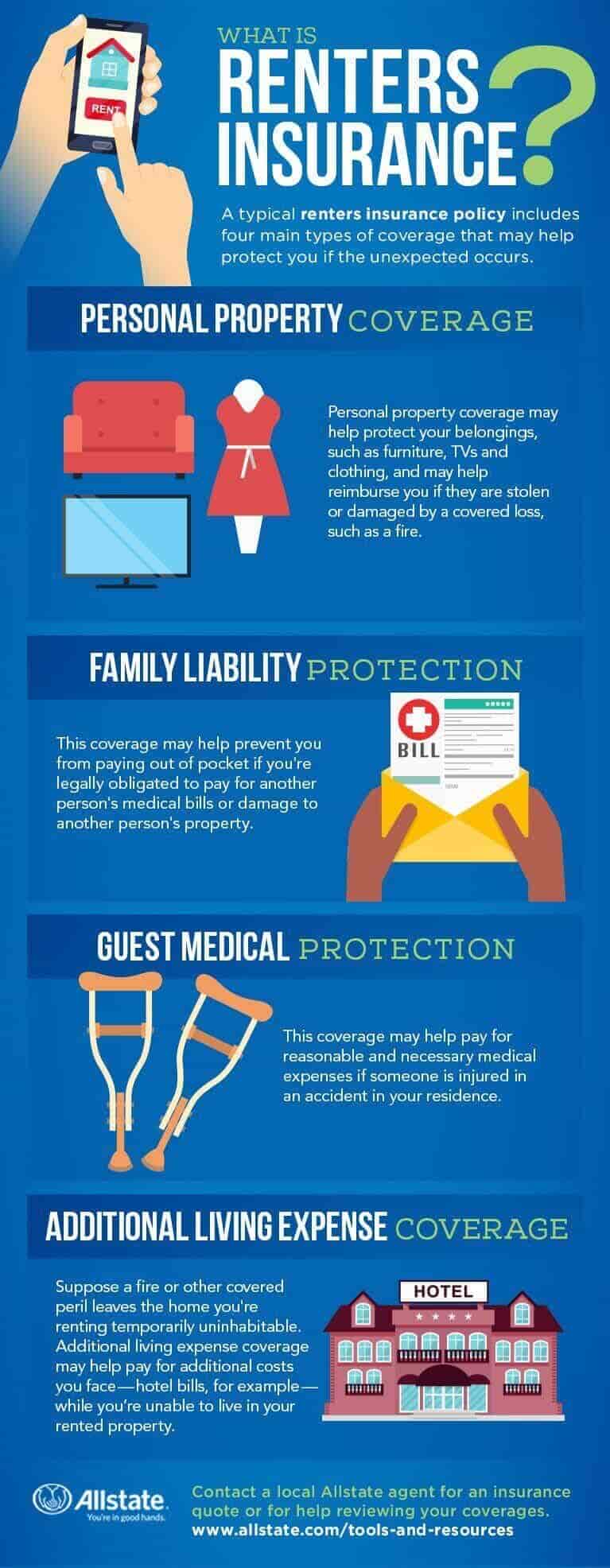

When it comes to renters insurance, there are many benefits to consider. Firstly, it covers your personal property if it's damaged or stolen. Secondly, it can also provide liability coverage for any accidents that happen in your rented space, like a slip and fall injury. Lastly, it can help with additional living expenses if you're temporarily displaced due to a covered loss.

Personally, I've experienced the benefits of renters insurance firsthand. When my apartment was broken into and my laptop was stolen, my renters insurance stepped in and covered the cost of a new one. Without it, I would have been stuck paying out-of-pocket for a replacement.

Is Renters Insurance Worth the Cost?

While you may initially think renters insurance is an unnecessary expense, the cost is relatively low in comparison to the benefits it provides. The average cost of renters insurance in Cheyenne ranges from $15-$30 a month, which is less than a dollar a day. This small investment can end up saving you thousands in the long run.

How to Choose the Right Renters Insurance in Cheyenne

When it comes to selecting renters insurance, it's essential to consider various factors such as the coverage limits, deductible, and premium. You should also evaluate the reputation and customer service of the insurance provider. To make the process easier, it's a good idea to shop around and compare quotes from different insurance companies.

What Does Renters Insurance Cover in Cheyenne?

When it comes to renters insurance, it's essential to know what it covers. Most insurance policies cover personal property, liability, and additional living expenses. Personal property coverage protects your belongings if they're damaged or stolen. Liability coverage protects you if someone is hurt in your rented space and sues you. Lastly, additional living expenses coverage helps pay for temporary living arrangements if your space is uninhabitable due to a covered loss.

Why You Should Consider Renters Insurance in Cheyenne

If you're still on the fence about renters insurance, consider the risks you're taking by not having it. In the event of a natural disaster, fire, theft, or other accidents, you could lose everything you own. With renters insurance, you can protect yourself and your belongings against unforeseen circumstances.

FAQs About Renters Insurance in Cheyenne

Q: What happens if I don't have renters insurance in Cheyenne?

A: If you don't have renters insurance in Cheyenne, you'll be responsible for paying out-of-pocket for any damages or losses that occur.

Q: How much renters insurance coverage do I need in Cheyenne?

A: The amount of renters insurance coverage you need in Cheyenne will depend on your personal belongings' value. It's essential to choose a policy that provides enough coverage for all your belongings.

Q: Does renters insurance cover all-natural disasters in Cheyenne?

A: Renters insurance typically covers natural disasters, including floods, lightning, and windstorms. However, you may need additional coverage for earthquakes or other types of disasters.

Q: Can I get renters insurance in Cheyenne if I have bad credit?

A: Yes, many insurance companies offer renters insurance to people with bad credit. However, you may end up paying a higher premium.

Conclusion

To sum up, renters insurance is essential if you're living in Cheyenne. It's a small investment that can save you thousands of dollars in the long run. When choosing renters insurance, be sure to shop around, evaluate the coverage, and don't hesitate to ask the insurance company questions.